The concept of a stock split, particularly the 4:1 stock split, is an important topic for investors and traders alike. In essence, a 4:1 stock split refers to the process where a company divides its existing shares into four new shares. This strategy is often employed to make shares more affordable for retail investors while maintaining the company's overall market capitalization. In this article, we will explore the intricacies of a 4:1 stock split, its advantages, potential downsides, and its impact on shareholders and the stock market.

Understanding the mechanics behind a 4:1 stock split can help investors make informed decisions regarding their portfolios. This article delves into the reasons why companies choose to initiate stock splits, particularly the 4:1 ratio, and how it affects both the company's stock price and the perception of its value. Additionally, we will cover the historical context of stock splits and provide examples of notable companies that have implemented this strategy.

As we navigate through this comprehensive guide, we will ensure to present data and insights that adhere to the principles of E-E-A-T (Expertise, Authoritativeness, Trustworthiness) and YMYL (Your Money or Your Life). By the end of this article, you'll have a clear understanding of the 4:1 stock split and its implications for your investment strategy.

Table of Contents

- What is a Stock Split?

- Understanding the 4:1 Stock Split

- Benefits of a 4:1 Stock Split

- Potential Downsides of a 4:1 Stock Split

- Historical Examples of 4:1 Stock Splits

- Impact on Shareholders

- Conclusion

- Frequently Asked Questions

What is a Stock Split?

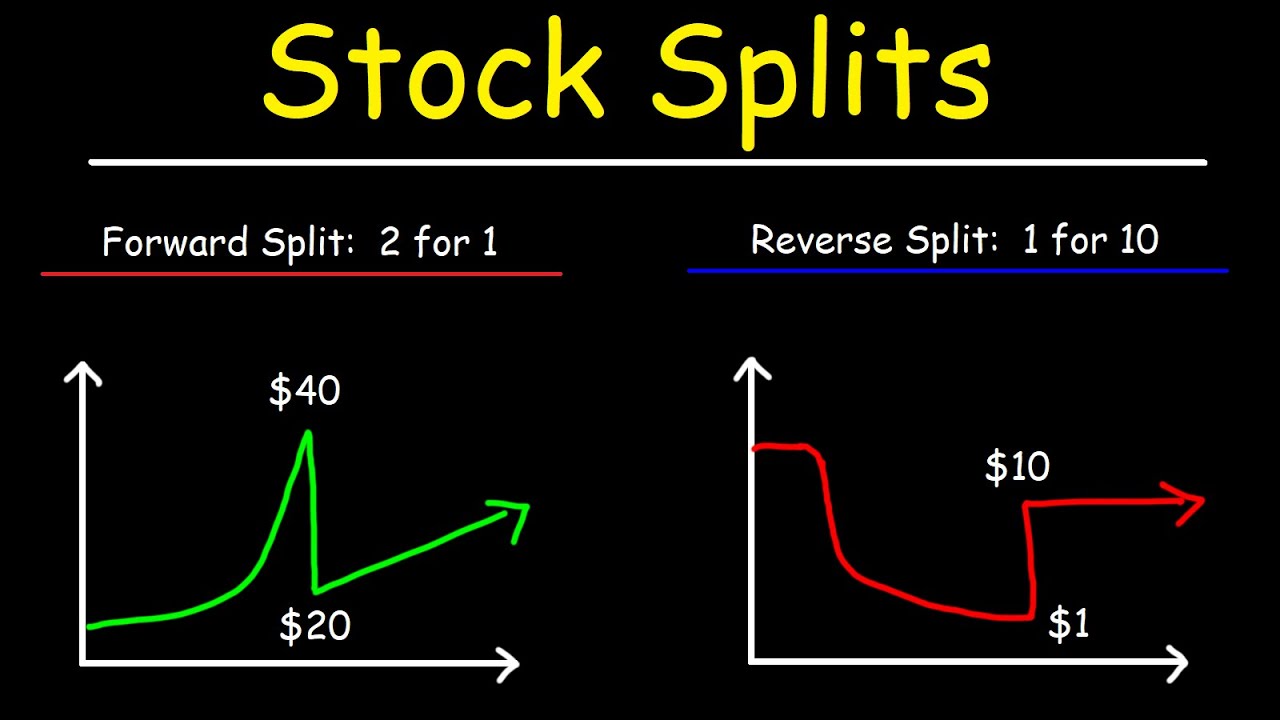

A stock split is a corporate action that increases the number of outstanding shares while reducing the share price proportionately. For instance, in a 4:1 stock split, each shareholder receives three additional shares for every share they already own. Consequently, if the stock was priced at $100 before the split, it would be adjusted to $25 post-split, maintaining the overall market capitalization of the company.

Understanding the 4:1 Stock Split

In a 4:1 stock split, the number of shares outstanding increases by four times, while the price per share is divided by four. This mechanism does not alter the overall value of the company but makes shares more accessible to a broader range of investors. Companies often pursue this strategy to enhance liquidity and attract more retail investors.

The Rationale Behind a 4:1 Split

- Accessibility: Lowering the price per share makes it feasible for more investors to purchase shares.

- Liquidity: An increase in the number of shares can enhance trading volume, making it easier to buy and sell shares.

- Market Perception: A lower stock price may create the perception of a more affordable and attractive investment.

Benefits of a 4:1 Stock Split

There are several benefits associated with a 4:1 stock split, including:

- Increased Investor Interest: Lower share prices tend to attract more retail investors, potentially driving up demand.

- Enhanced Marketability: A more attractive price point can improve the company's image and marketability.

- Improved Liquidity: More shares available for trading can lead to better liquidity, making it easier for investors to enter and exit positions.

Potential Downsides of a 4:1 Stock Split

While a 4:1 stock split has numerous advantages, it also comes with potential downsides that investors should consider:

- Market Misinterpretation: Some investors may misinterpret the stock split as a sign of weakness or instability.

- Temporary Price Adjustments: Following a split, stock prices may experience volatility as the market adjusts to the new share structure.

- Not a Fundamental Change: A stock split does not inherently improve the company's financial health or performance.

Historical Examples of 4:1 Stock Splits

Several well-known companies have executed 4:1 stock splits in the past, including:

- Apple Inc. (AAPL): Apple conducted a 4:1 stock split in 2020, which significantly increased its accessibility to investors.

- Amazon.com, Inc. (AMZN): Amazon has also implemented stock splits to enhance liquidity and attract retail investors.

- Google LLC (GOOGL): Google's stock split strategy has allowed it to maintain a competitive edge in the tech industry.

Impact on Shareholders

The impact of a 4:1 stock split on shareholders can be both immediate and long-term. Initially, shareholders may see a change in their share count and price, but their overall investment value remains unchanged. Over time, however, increased liquidity and investor interest could lead to potential price appreciation.

Conclusion

In summary, the 4:1 stock split is a strategic move that many companies utilize to enhance liquidity and broaden their investor base. While it offers several benefits, such as increased accessibility and improved market perception, it is essential for investors to remain aware of the potential downsides. Understanding the implications of a stock split can help investors make informed decisions regarding their investment strategies.

We encourage you to share your thoughts on stock splits in the comments below, and don't hesitate to explore more articles on our site for further insights into the stock market and investment strategies.

Frequently Asked Questions

What happens to my shares during a 4:1 stock split?

During a 4:1 stock split, each shareholder receives three additional shares for every share they own, resulting in a total of four shares at a reduced price.

Does a stock split affect the value of my investment?

No, the overall value of your investment remains the same immediately after the split; only the number of shares and price per share change.

Why do companies choose a 4:1 stock split over other ratios?

Companies may choose a 4:1 stock split to strike a balance between making shares affordable while still maintaining a reasonable share price for institutional investors.

Can a stock split impact dividends?

Yes, if a company pays dividends, the amount paid per share may be adjusted post-split to reflect the new number of shares outstanding.

Article Recommendations

- Bloxburg Job Salary List 2024

- Travis Kelce Place Of Birth

- Viper Rapper The Rise Of A Controversial Hiphop Icon