In recent years, the rise of social media platforms has transformed the way we communicate, share information, and conduct business. This digital revolution has opened up new avenues for investment, particularly through the emergence of Social Media ETFs (Exchange-Traded Funds). Social Media ETFs provide investors with a unique opportunity to gain exposure to companies that dominate the social media landscape, allowing them to capitalize on the growth of this dynamic sector.

The concept of investing in a diversified portfolio of social media stocks through ETFs is not only appealing for its potential returns but also for its accessibility to a wider range of investors. As social media continues to evolve and influence various aspects of our lives, understanding the intricacies of Social Media ETFs becomes increasingly crucial for anyone looking to navigate this modern investment landscape.

In this comprehensive guide, we will delve into the essential aspects of Social Media ETFs, including their structure, key players, performance metrics, and the risks associated with investing in this sector. By the end of this article, you will have a thorough understanding of Social Media ETFs and how they can fit into your investment strategy.

Table of Contents

- What is a Social Media ETF?

- Benefits of Investing in Social Media ETFs

- Top Social Media ETFs to Consider

- How to Invest in Social Media ETFs

- Risks Associated with Social Media ETFs

- The Future of Social Media ETFs

- Conclusion

- Frequently Asked Questions

What is a Social Media ETF?

A Social Media ETF is a type of exchange-traded fund that invests primarily in stocks of companies that are involved in the social media industry. These companies can range from social networking platforms to digital advertising firms, and even technology companies that provide the infrastructure for social media operations. The goal of a Social Media ETF is to offer investors a diversified portfolio that reflects the performance of the broader social media sector.

Social Media ETFs typically track an index composed of social media stocks. For example, one popular index is the “S-Network Social Media Index,” which measures the performance of publicly traded companies that derive a significant portion of their revenue from social media. By investing in an ETF, investors can gain exposure to a range of companies rather than putting all their money into a single stock, thereby reducing risk.

Benefits of Investing in Social Media ETFs

Investing in Social Media ETFs comes with several advantages:

- Diversification: Social Media ETFs allow investors to spread their risk across multiple companies within the social media sector, reducing the impact of poor performance by any single stock.

- Liquidity: As with other ETFs, Social Media ETFs are traded on stock exchanges, making them easily accessible and liquid for investors.

- Cost-Effective: ETFs often have lower expense ratios compared to mutual funds, making them a cost-effective option for investors.

- Exposure to Growth: The social media industry has shown significant growth over the past decade, and investing in Social Media ETFs allows investors to tap into this growth potential.

Top Social Media ETFs to Consider

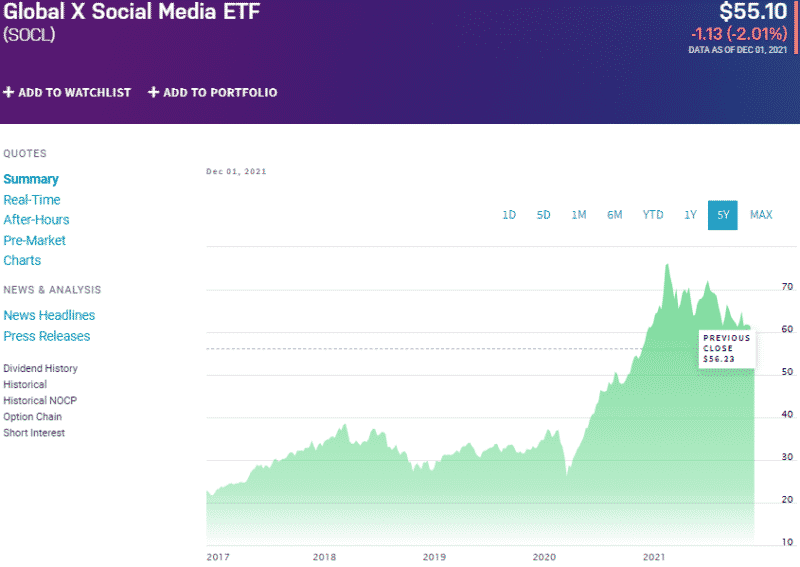

When it comes to investing in Social Media ETFs, there are several options available. Here are some of the most notable ETFs in this category:

| ETF Name | Ticker Symbol | Expense Ratio | Top Holdings |

|---|---|---|---|

| Global X Social Media ETF | SOCIAL | 0.65% | Facebook, Twitter, Snap |

| Roundhill BITKRAFT Esports & Digital Entertainment ETF | 0.75% | Activision Blizzard, Electronic Arts, Take-Two Interactive | |

| Invesco S&P 500 Equal Weight Communication Services ETF | EWCO | 0.40% | Facebook, Alphabet, Netflix |

How to Invest in Social Media ETFs

Investing in Social Media ETFs is a straightforward process. Here’s a step-by-step guide:

- Open a Brokerage Account: Choose a reputable brokerage firm that offers access to ETFs and open an account.

- Research ETFs: Use the information provided in this article to identify Social Media ETFs that align with your investment goals.

- Place Your Order: Once you have selected an ETF, you can place a buy order through your brokerage account.

- Monitor Your Investment: Keep track of the performance of your chosen ETF and be prepared to make adjustments to your portfolio as needed.

Risks Associated with Social Media ETFs

While Social Media ETFs offer many benefits, they also come with certain risks:

- Market Volatility: The social media sector can be highly volatile, and ETF prices can fluctuate significantly based on market conditions.

- Regulatory Risks: Social media companies are subject to regulatory scrutiny, which could impact their stock performance.

- Concentration Risk: Some ETFs may have a heavy concentration in a few large companies, which could increase risk if those companies underperform.

The Future of Social Media ETFs

The future of Social Media ETFs looks promising as the digital landscape continues to evolve. With the rise of new technologies such as artificial intelligence and virtual reality, social media companies may find new ways to engage users and monetize their platforms.

Moreover, as more investors seek exposure to the tech sector, Social Media ETFs are likely to gain popularity, leading to increased liquidity and potentially better performance. However, investors should remain vigilant and stay informed about market trends and potential risks associated with this dynamic industry.

Conclusion

In summary, Social Media ETFs represent an exciting investment opportunity for those looking to capitalize on the growth of the digital landscape. By understanding the structure, benefits, and risks of these ETFs, investors can make informed decisions that align with their financial goals.

As you consider your investment options, take the time to research various Social Media ETFs and evaluate how they fit into your overall investment strategy. We encourage you to share your thoughts and experiences in the comments below and explore our other articles for more insights into the world of investing.

Frequently Asked Questions

1. What are the main companies included in Social Media ETFs?

Most Social Media ETFs include major players like Facebook, Twitter, and Snapchat, as well as other digital marketing and technology companies.

2. How can I track the performance of my Social Media ETF?

You can track the performance of your ETF through your brokerage account, financial news websites, or dedicated financial apps that provide real-time market data.

3. Are Social Media ETFs suitable for long-term investment?

Yes, Social Media ETFs can be suitable for long-term investments, especially if you believe in the continued growth of the social media industry.

Article Recommendations