Kaizen Capital is revolutionizing the way we approach investment strategies by embracing the principles of continuous improvement and sustainable growth. In today's fast-paced financial landscape, the concept of Kaizen, which means "change for better" in Japanese, has become a vital framework for investors seeking to enhance their portfolios and long-term success. This article delves into the essence of Kaizen Capital, its methodologies, and how it can be a game-changer for investors.

As investors navigate through the complexities of the market, applying the Kaizen philosophy can lead to more informed decision-making and ultimately better financial outcomes. The beauty of Kaizen lies in its simplicity and effectiveness, making it accessible to both seasoned investors and those new to the financial world. This article aims to provide a comprehensive understanding of Kaizen Capital, its foundational principles, and its practical applications in investment strategies.

By the end of this article, readers will not only grasp the significance of Kaizen Capital but also learn how to implement its strategies in their investment practices. Whether you're looking to optimize your portfolio or seeking innovative ways to approach financial growth, this guide is tailored to equip you with the knowledge you need.

Table of Contents

- What is Kaizen Capital?

- Principles of Kaizen Capital

- The Kaizen Approach to Investment

- Key Benefits of Kaizen Capital

- Case Studies of Success

- Implementing Kaizen in Your Investments

- The Future of Kaizen Capital

- Conclusion

What is Kaizen Capital?

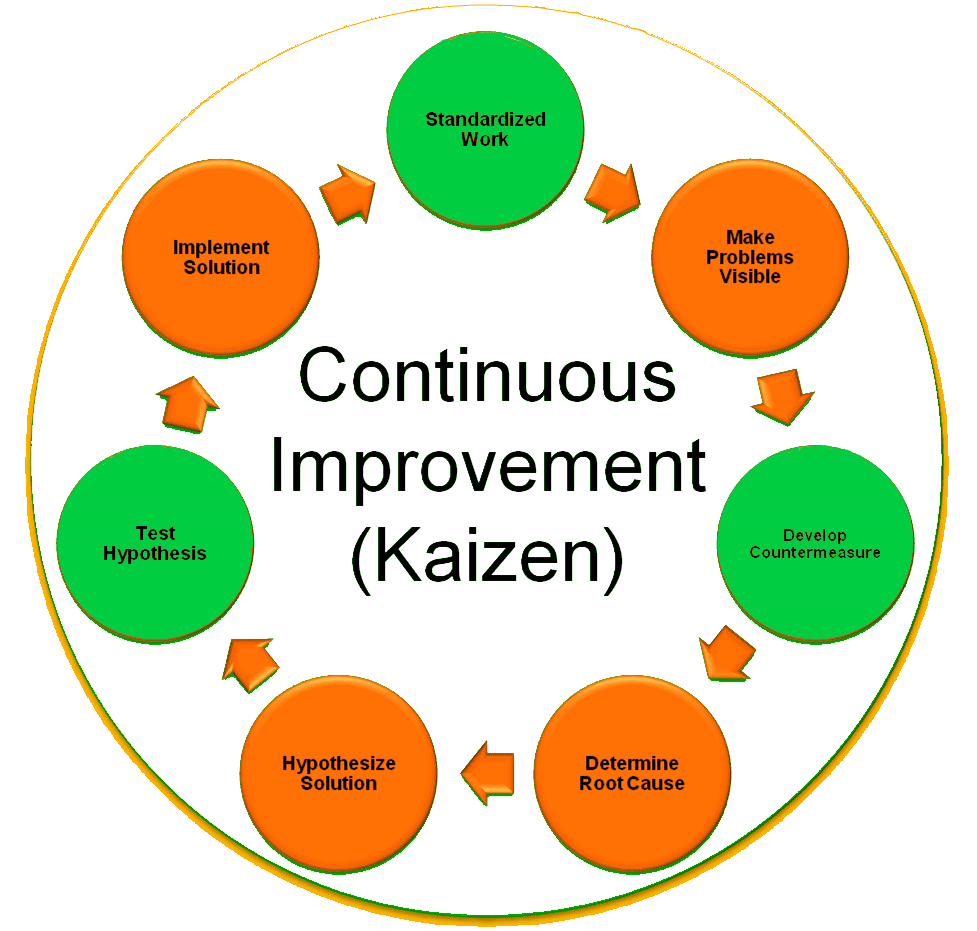

Kaizen Capital refers to an investment philosophy that incorporates the Japanese concept of continuous improvement into financial strategies. At its core, Kaizen emphasizes incremental changes that lead to significant enhancements over time. This approach is not limited to business operations but extends to personal finance and investment as well.

Investors adopting Kaizen Capital focus on small, manageable changes in their investment strategies, which can lead to substantial long-term benefits. This philosophy encourages a proactive mindset, where investors are constantly looking for ways to improve their practices, reduce waste, and maximize returns.

Principles of Kaizen Capital

The principles of Kaizen Capital can be summarized into several key tenets that guide investors in their journey toward sustainable growth:

- Continuous Improvement: Always seek ways to enhance investment strategies, even if the changes are small.

- Data-Driven Decision Making: Utilize data and analytics to inform investment choices and track progress.

- Elimination of Waste: Identify and reduce inefficiencies in investment processes to optimize performance.

- Collaboration and Feedback: Foster a culture of collaboration, where feedback is encouraged and valued to drive improvements.

- Long-Term Focus: Prioritize sustainable practices that promote long-term financial health over short-term gains.

The Kaizen Approach to Investment

The Kaizen approach to investment involves several strategies that are built on its core principles. Below are some key methods:

1. Regular Portfolio Review

Conducting regular reviews of your investment portfolio allows you to identify areas for improvement. This could involve reallocating assets, rebalancing, or even divesting from underperforming investments.

2. Incremental Adjustments

Instead of making drastic changes, focus on making small, incremental adjustments to your investment strategies. This can help mitigate risks while still providing opportunities for growth.

3. Learning from Mistakes

Embrace failures as learning opportunities. Analyze past investment decisions to identify what worked and what didn’t, and apply these lessons to future strategies.

4. Staying Informed

Keep abreast of market trends, economic indicators, and new investment opportunities. Continuous learning is a crucial aspect of the Kaizen philosophy.

Key Benefits of Kaizen Capital

Implementing Kaizen Capital principles can yield numerous benefits for investors, such as:

- Improved Decision-Making: A systematic approach to investing leads to better-informed decisions.

- Enhanced Returns: Continuous improvement can lead to optimized portfolios and higher returns over time.

- Risk Mitigation: Incremental changes allow for better risk management without exposing the investor to high levels of volatility.

- Increased Efficiency: Streamlining investment processes reduces wasted time and resources.

- Stronger Investor Confidence: A proactive approach fosters confidence in investment decisions and strategies.

Case Studies of Success

Several organizations have successfully implemented Kaizen Capital strategies and achieved remarkable results. Here are a few notable case studies:

1. Toyota Financial Services

Toyota Financial Services adopted Kaizen principles to streamline their investment processes, resulting in significant cost savings and improved customer satisfaction.

2. Unilever

Unilever utilized continuous improvement methodologies to enhance their investment in sustainable practices, leading to higher returns and a stronger brand reputation.

3. Berkshire Hathaway

Berkshire Hathaway's investment philosophy aligns closely with Kaizen principles, focusing on long-term value creation through careful analysis and incremental adjustments.

Implementing Kaizen in Your Investments

To effectively implement Kaizen Capital in your investment strategy, consider the following steps:

- Set Clear Goals: Define what you want to achieve with your investments, whether it's capital appreciation, income generation, or risk management.

- Analyze Current Strategies: Review your existing investment strategies to identify areas for improvement.

- Make Incremental Changes: Start small by adjusting one aspect of your portfolio at a time.

- Monitor Progress: Keep track of your investment performance and make adjustments as necessary.

- Stay Committed: Embrace the Kaizen philosophy as a lifelong commitment to continuous improvement.

The Future of Kaizen Capital

The future of Kaizen Capital looks promising as more investors recognize the value of continuous improvement in their financial strategies. As technology advances and data analytics becomes more sophisticated, the ability to implement Kaizen principles will only become more effective. Investors will increasingly rely on real-time data to make informed decisions, further enhancing the benefits of the Kaizen approach.

Moreover, as sustainability becomes a critical focus in investing, Kaizen Capital aligns well with ESG (Environmental, Social, and Governance) criteria, promoting responsible investing practices that benefit both society and the environment.

Conclusion

In summary, Kaizen Capital represents a transformative approach to investing that emphasizes continuous improvement and sustainable growth. By adopting the principles of Kaizen, investors can enhance their decision-making processes, optimize their portfolios, and ultimately achieve greater financial success.

We encourage you to explore the concepts discussed in this article and consider how you can implement Kaizen strategies in your investment practices. Share your thoughts in the comments below, and don’t forget to check out our other articles for more insights into effective investment strategies!

Thank you for reading, and we look forward to welcoming you back for more valuable content on investment and finance!

Article Recommendations

- Simon Guobadia Net Worth

- Lily Rose Depp Ankles

- Unveiling The Allure Hilary Duff Nude And The Art Of Celebrity Vulnerability