In the world of finance, understanding the short interest of a stock can provide valuable insights into market sentiment and investor behavior. CXAI, a company that has garnered attention in recent months, is no exception. With the rising interest in AI and technology stocks, CXAI's short interest has become a topic of discussion among investors and analysts alike. This article aims to delve deep into the concept of short interest, how it relates to CXAI, and what it means for potential investors.

Short selling is a strategy used by investors who anticipate that the price of a stock will decline. By borrowing shares and selling them at the current market price, these investors hope to buy them back at a lower price, thus profiting from the difference. The short interest represents the total number of shares that have been sold short but not yet covered. A high short interest can indicate that investors are bearish on a stock, while a low short interest may suggest a bullish sentiment.

This article will explore the short interest of CXAI, examining the factors that contribute to its fluctuations and the implications for investors. We will also provide a comprehensive analysis, backed by data and expert opinions, to equip readers with the knowledge they need to navigate the complexities of investing in CXAI.

Table of Contents

- 1. What is Short Interest?

- 2. Overview of CXAI

- 3. CXAI Short Interest Trends

- 4. Factors Affecting CXAI Short Interest

- 5. Analyzing Investor Sentiment

- 6. Investment Strategies Involving Short Interest

- 7. Relevant Data and Statistics

- 8. Conclusion

1. What is Short Interest?

Short interest is a financial metric that indicates the total number of shares of a stock that have been sold short and not yet repurchased. It serves as a gauge of market sentiment, reflecting whether investors believe a stock's price will fall. The short interest ratio, calculated by dividing the number of shares sold short by the stock's average daily trading volume, provides insight into how many days it would take for short sellers to cover their positions.

2. Overview of CXAI

CXAI is a technology company specializing in artificial intelligence solutions. Founded in [Year], it has quickly gained traction in the market due to its innovative products and services. Below is a brief biodata of CXAI:

| Data Point | Details |

|---|---|

| Founded | [Year] |

| Headquarters | [Location] |

| CEO | [CEO Name] |

| Industry | Artificial Intelligence |

| Stock Symbol | CXAI |

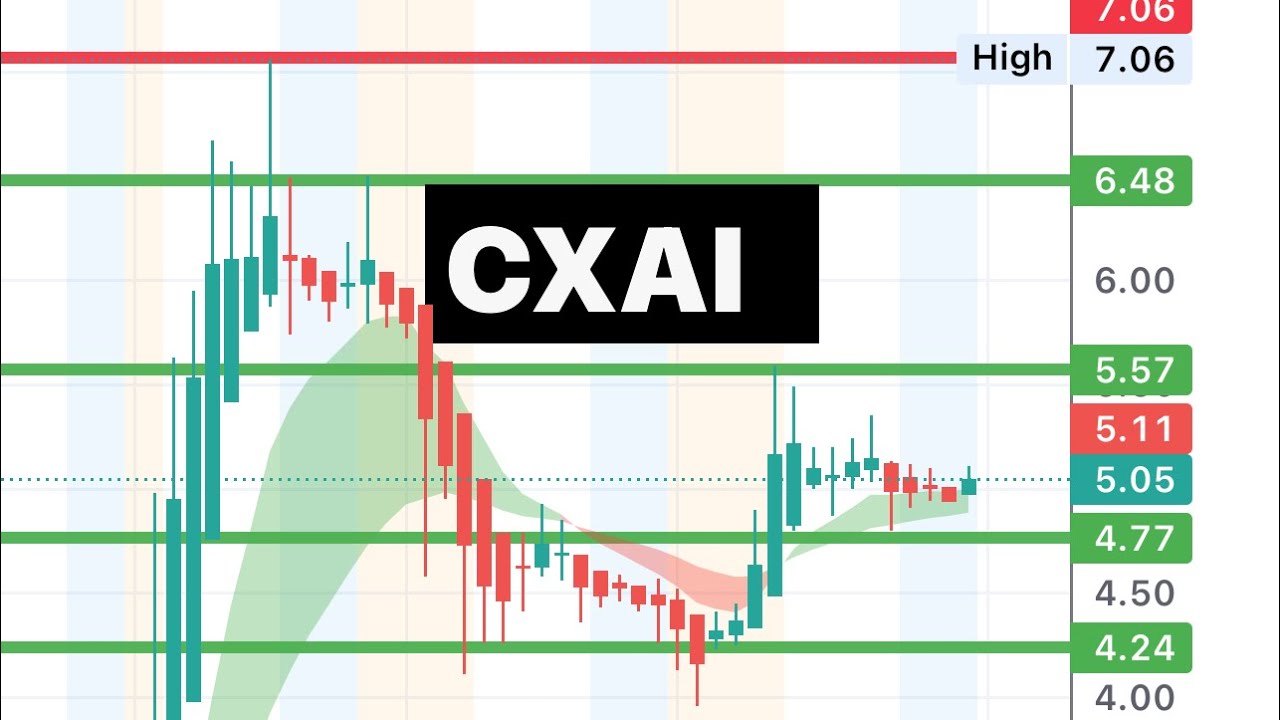

3. CXAI Short Interest Trends

The short interest in CXAI has seen significant fluctuations over the past few months. Investors often look at these trends to assess market behavior and potential price movements. A sudden increase in short interest may indicate growing bearish sentiment, while a decrease might suggest a shift towards bullishness.

Recent Data on CXAI Short Interest

- Current short interest: [Insert Data]

- Percentage of float shorted: [Insert Data]

- Short interest ratio: [Insert Data]

4. Factors Affecting CXAI Short Interest

Several factors can influence the short interest of CXAI, including:

- Market Trends: General market conditions and investor sentiment can greatly impact short interest.

- Company Performance: Earnings reports, product launches, and other company developments play a crucial role.

- News and Media Coverage: Positive or negative news can sway investor opinions and affect short selling.

- Regulatory Changes: Changes in regulations regarding short selling can also impact short interest levels.

5. Analyzing Investor Sentiment

Understanding investor sentiment is essential for predicting stock price movements. Various tools and indicators can help gauge sentiment, including:

- Short Interest Ratio: A higher ratio suggests that a significant number of investors are betting against the stock.

- Put/Call Ratio: This ratio can indicate whether investors are hedging against a price decline.

- Social Media Sentiment: Analysis of social media discussions can provide insights into investor attitudes.

6. Investment Strategies Involving Short Interest

Investors can employ various strategies when considering short interest, such as:

- Short Selling: Investors may choose to short sell shares of CXAI if they believe the stock is overvalued.

- Contrarian Investing: Some investors may buy shares when short interest is high, betting on a reversal.

- Monitoring Short Squeeze Potential: Investors look for stocks with high short interest that may experience a short squeeze.

7. Relevant Data and Statistics

To make informed investment decisions, it's essential to rely on credible data sources. Some reputable sources include:

- Yahoo Finance

- NASDAQ

- MarketWatch

According to [Source], the current short interest in CXAI stands at [Insert Data], which indicates a [bullish/bearish] sentiment among investors.

8. Conclusion

In summary, understanding CXAI's short interest provides valuable insights into market sentiment and potential investment opportunities. Investors should keep a close eye on short interest trends, market conditions, and company performance to make informed decisions. Engaging with the stock market requires a careful approach, and analyzing short interest is one of the many tools at an investor's disposal.

We encourage readers to share their thoughts on CXAI and its short interest in the comments below. For more insights and updates on financial topics, consider subscribing to our newsletter or exploring our other articles.

Thank you for reading! We hope to see you back here for more informative content.

Article Recommendations

- Unveiling The Enigma Of Yuen Qiu A Journey Through Cinema

- Jude Bellingham Parents Nationality

- Lust Goddess