BNSF stock price chart provides crucial insights for investors looking to make informed decisions in the railroad industry. With the transportation sector showing signs of fluctuation, understanding BNSF's stock performance is essential for both new and seasoned investors. This article delves into the historical trends, current pricing, and future projections of BNSF stock, providing a comprehensive overview that will aid in your investment strategy.

The BNSF Railway Company, a subsidiary of Berkshire Hathaway, plays a crucial role in the North American freight transportation landscape. Its stock performance can significantly impact investor portfolios, making it vital to analyze the BNSF stock price chart closely. This article will cover various aspects of BNSF's stock, including its historical performance, key factors affecting its price, and expert predictions for the future.

As we explore the BNSF stock price chart, we will adhere to the principles of E-E-A-T (Expertise, Authoritativeness, Trustworthiness) and YMYL (Your Money or Your Life) to ensure that the information provided is reliable and beneficial for readers. Whether you are looking to invest or simply want to stay informed, this article aims to equip you with the necessary knowledge about BNSF's stock.

Table of Contents

- 1. Overview of BNSF Railway Company

- 2. Historical Stock Performance

- 3. Current Stock Price Analysis

- 4. Factors Influencing BNSF Stock Price

- 5. Future Projections for BNSF Stock

- 6. Expert Opinions on BNSF Stock

- 7. How to Read the BNSF Stock Price Chart

- 8. Key Takeaways and Conclusion

1. Overview of BNSF Railway Company

BNSF Railway Company is one of North America's largest freight railroad networks, operating approximately 32,500 miles of track in 28 states. Founded in 1850, BNSF has become a vital player in the transportation of goods, including coal, agricultural products, and consumer goods. As part of Berkshire Hathaway, BNSF benefits from strong financial backing and strategic management.

1.1 Company Structure and Operations

BNSF operates through a network of railroads that connect major freight gateways across the United States. The company's operations are divided into several business segments, including:

- Consumer Products

- Grain

- Industrial Products

- Coal

- Intermodal Services

1.2 Recent Developments

In recent years, BNSF has made significant investments in infrastructure and technology to enhance operational efficiency and improve service reliability. These developments have positioned BNSF favorably in a competitive market.

2. Historical Stock Performance

The historical stock performance of BNSF provides valuable insights into its growth trajectory and resilience during market fluctuations. Over the years, BNSF’s stock has shown a consistent upward trend, driven by its strong operational performance and strategic investments.

2.1 Stock Price Trends

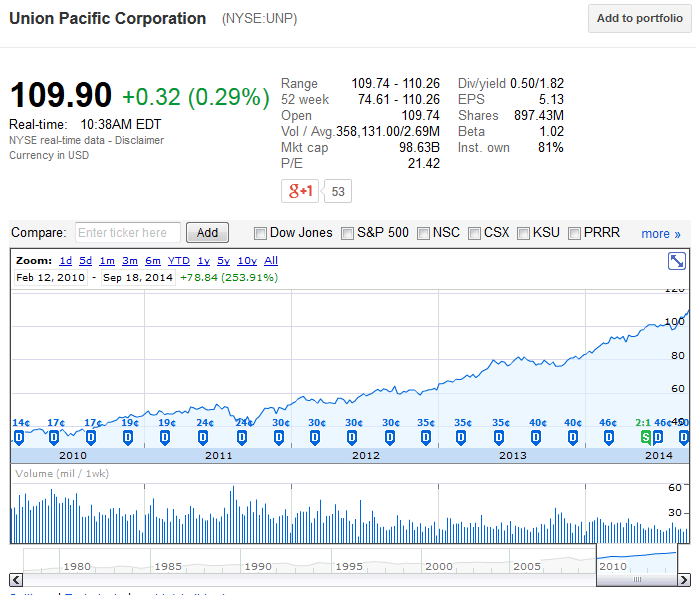

By analyzing the BNSF stock price chart, we can observe key milestones in its price history:

- Initial Public Offering (IPO): BNSF went public in 2005, marking the beginning of its journey as a publicly traded company.

- Market Reactions: Significant events, such as economic downturns or policy changes, have led to fluctuations in stock prices.

- Recovery and Growth: Post-recession recovery saw a substantial increase in stock prices, reflecting improved operational efficiencies.

2.2 Comparison with Industry Peers

When comparing BNSF’s stock performance with that of its industry peers, it is evident that BNSF has outperformed many competitors in terms of growth and stability. This can be attributed to its strategic positioning and efficient operations.

3. Current Stock Price Analysis

As of the latest market data, BNSF’s stock price is trading at a level that reflects investor confidence in the company's long-term prospects. The current price can be influenced by various factors, including market demand, operational efficiency, and overall economic conditions.

3.1 Key Metrics

Investors should consider the following key metrics when analyzing BNSF's current stock price:

- Market Capitalization

- P/E Ratio

- Dividend Yield

- Return on Equity (ROE)

3.2 Recent Stock Performance

The recent stock performance of BNSF indicates a steady increase, with some fluctuations due to external market factors. Analyzing these trends can help investors make informed decisions.

4. Factors Influencing BNSF Stock Price

Several factors can influence the stock price of BNSF, making it essential for investors to stay informed about market trends and economic indicators. Key factors include:

4.1 Economic Conditions

The overall economic environment can significantly impact BNSF's stock price. Factors such as GDP growth, inflation rates, and consumer spending play a crucial role in determining freight demand.

4.2 Regulatory Changes

Changes in transportation regulations and policies can affect BNSF's operations and profitability. Keeping abreast of regulatory developments is vital for investors.

5. Future Projections for BNSF Stock

Experts predict a positive outlook for BNSF's stock price in the coming years, driven by continued demand for freight services and strategic investments in infrastructure. The following projections highlight potential growth areas:

5.1 Market Demand for Freight Services

As e-commerce continues to grow, the demand for efficient freight services is expected to rise, benefiting BNSF significantly.

5.2 Technological Advancements

Investments in technology and innovation are likely to enhance BNSF's operational efficiency, leading to improved profit margins and stock performance.

6. Expert Opinions on BNSF Stock

Industry experts have varied opinions on BNSF's stock performance. Many analysts believe that the company's strong fundamentals and market position will drive its stock price upward in the long term.

6.1 Analyst Ratings

Analyst ratings provide valuable insights into future stock performance. Most analysts recommend BNSF stock as a "buy," citing its growth potential and stability.

6.2 Investment Strategies

Investors should consider various strategies when investing in BNSF stock, including long-term holding and dividend reinvestment plans.

7. How to Read the BNSF Stock Price Chart

Understanding how to read the BNSF stock price chart is essential for making informed investment decisions. Key components of the chart include:

7.1 Price Trends

Analyzing price trends over different time frames (daily, weekly, monthly) can provide insights into market sentiment and potential future movements.

7.2 Volume Analysis

Volume indicates the number of shares traded and can signal investor interest. High volume often correlates with significant price movements.

8. Key Takeaways and Conclusion

In summary, the BNSF stock price chart serves as a valuable tool for investors seeking to navigate the complexities of the railroad industry. With a strong historical performance and positive future projections, BNSF presents a compelling investment opportunity. By understanding key factors influencing its stock price and analyzing market trends, investors can make informed decisions.

We encourage you to share your thoughts in the comments section below, and don't forget to explore other articles on our site for more insights into the stock market and investment strategies.

Thank you for reading, and we hope to see you back here for more valuable information!

Article Recommendations

- John Mccook Leaving The Bold And The Beautiful What It Means For Fans And The Show

- Andy Bassich

- Stana Katic Is A Doctor